#Nifty Trading Tips

Explore tagged Tumblr posts

Text

What is the psychology of successful traders? | NTA®

Discover the psychology behind successful traders—exploring essential mindset traits, emotional discipline, and proven strategies to maintain focus and profitability.

0 notes

Text

Crude Oil Nears $78 After U.S.-Iran Conflict: Expert Targets for ONGC, HPCL, IOCL, BPCL - Intraday Trading

Crude oil prices surged in intraday trading on Monday, June 23, after U.S. airstrikes targeted Iran’s nuclear sites over the weekend. The geopolitical tension spooked markets, dragging down shares of downstream oil marketing companies (OMCs). Adding to the pressure, Iran’s parliament approved a proposal to shut the Strait of Hormuz — a key chokepoint that handles nearly 20% of global oil and LNG shipments — raising fresh concerns about supply disruptions and market volatility.

Brent crude prices jumped two percent to hover near $78/bbl, while WTI crude climbed 1.7 percent to $75/bbl, as a risk-off sentiment took hold.

When crude oil prices rise, shares of oil marketing companies often come under pressure, as their input costs increase but they may not be able to fully pass on the hike to consumers due to pricing regulations or concerns about demand, which impacts their profit margins.

Stock Market Strategy for OIL Stocks

Oil and Natural Gas Corporation Ltd (ONGC) - Current Price: ₹252.33 (+0.44%) | Buy Price Target: ₹260–₹265 | Stop Loss: ₹245 | Target Price: ₹290

Oil India Ltd - Current Price: ₹466.95 (+0.5%) | Buy Price Target: ₹475–₹480 | Stop Loss: ₹455 | Target Price: ₹500–₹590

>>> Get an advanced Stock Market Strategy. Register now!

Hindustan Petroleum Corporation Ltd (HPCL) - Current Price: ₹389.7 (-0.7%) | Buy Price Target: ₹400–₹410 | Stop Loss: ₹380 | Target Price: ₹430–₹450

Bharat Petroleum Corporation Ltd (BPCL) - Current Price: ₹311.35 (-0.69%) | Buy Price Target: ₹320–₹325 | Stop Loss: ₹305 | Target Price: ₹340–₹350

Indian Oil Corporation Ltd (IOCL) - Current Price: ₹137.05 (-1.15%) | Buy Price Target: ₹140–₹145 | Stop Loss: ₹132 | Target Price: ₹150–₹160

Coal India Ltd - Current Price: ₹386.35 (-0.69%) | Buy Price Target: ₹395–₹400 | Stop Loss: ₹380 | Target Price: ₹410–₹420

What do brokerages say?

Emkay Global says there's no real threat to the profits of HPCL, BPCL, and IOCL unless crude oil stays above $75 a barrel. Falling LPG prices and government subsidies could actually give their earnings a nice boost.

JM Financial is bullish on ONGC and Oil India, saying higher crude prices work in their favor. Just a $1 rise in oil can lift their earnings by up to 2%.

JM Financial isn't as excited about HPCL, IOCL, and BPCL. It believes these companies are priced too high and their big spending plans could be risky.

With crude staying high or the government adjusting fuel prices, the big profits that oil marketing companies (OMCs) are enjoying now could come back down to normal levels.

Level up your investing game. Get an advanced Stock Market Strategy. Register now - www.intensifyresearch.com or call -9111777433

Investment in the securities market is subject to market risks.

#best bank nifty tips provider#best bank nifty option tips#ideal strategies#share market advisory#accurate stock tips#stock cash market tips#ipo news#stock tips advisor#trading tips#ipo alert

1 note

·

View note

Text

Stocks to buy today-

1] ADSL: Buy at ₹182.70, target ₹192, stop loss ₹175; & 2] Mahindra Logistics: Buy at ₹525, target ₹550, stop loss ₹505; 3] OCCL: Buy at ₹810, target ₹850, stop loss ₹780; 4] Canara Bank: Buy at ₹119, target ₹126, stop loss ₹115; 5] Indian Terrain Fashions: Buy at ₹75.40, target ₹79, stop loss ₹72.75; 6] Vardhman Holdings: Buy at ₹4043.35, target ₹4250, stop loss ₹3900.

Get comprehensive insights from SEBI Registered Experts FILL https://intensifyresearch.com/web/landingpage NOW & avail 3 Days FREE TRIAL

#stock market#banknifty#investing#economy#nifty50#nse#sensex#nifty prediction#share market#finance#bse#bse sensex#bseindia#niftytrading#nifty#nseindia#nifty today#trading tips#option trading#investors#investment#investing stocks#financial#financial freedom#income#invest#fintech#blockchain#crypto#stock trading

3 notes

·

View notes

Text

Trading Support, Resistance, Sensex, Nifty50, Bank Nifty: What to Expect from the Indian Stock Market on Tuesday, 08-04-2025

“Get the latest insights on Indian stock market trends for Tuesday, 08-04-2025. Discover key support and resistance levels for Nifty50 and Bank Nifty, top 10 gainers and losers, and expert analysis to inform your trading decisions. Stay ahead of the market with our in-depth predictions and updates.” The Indian stock market has been a rollercoaster in recent weeks, with the Sensex, Nifty50, and…

#Bank Nifty analysis#Indian stock market trends#market predictions#Nifty50 prediction#Sensex updates#stock market insights#stock market news#support and resistance levels#top gainers and losers#Trading Tips

0 notes

Text

7 Strategies for Successful Options Trading Trading options within a single day or short-term has become a popular choice among traders looking to capitalize on price movements. But it takes talent, self-control, and practical tactics to master. TechnoFunda offers expert options trading tips and research.

0 notes

Text

0 notes

Text

11-JULY-2024 NIFTY 24500 PE S/L TWICE HIT LOSS Rs. 4,920 , LOSS Rs. 4,920 TOTAL LOSS Rs. 9,840

www.goldenoptions.in https://wa.me/6379365521

#niftytrading#youtube#nseindia#share market#banknifty#trade#trading tips#options trading#stock market#investing#nifty

1 note

·

View note

Text

8 mistakes you should avoid to become a successful trader | NTA®

Steer clear of these 8 frequent trading errors to boost your performance. Understand what to avoid and make more informed choices in the market for improved outcomes.

0 notes

Text

StreetGains is your ultimate resource for the best Bank Nifty trading tips. Our team of experts delivers insightful, data-driven advice to help you navigate the complexities of Bank Nifty trading. Whether you're a seasoned trader or just starting, StreetGains provides the strategies and tips needed to maximize your profits and minimize risks in the dynamic world of Bank Nifty trading.

URL: https://streetgains.in/bank-nifty-tips-provider

0 notes

Text

HDFC Bank Rises on HDB IPO; SBI Eyes ₹960 Target – Intraday and Long-Term Strategy Breakdown

Shares of HDFC Bank surged 1.2% to ₹1,954.80 at 10:20 AM in Friday’s session, after its non-banking finance arm, HDB Financial Services, announced the launch of its much-anticipated initial public offering (IPO). The ₹12,500-crore public issue — India’s largest by a non-bank lender — is set to open for subscription on Wednesday, June 25, sparking fresh momentum in the stock and renewed interest among intraday trading enthusiasts.

HDFC Bank confirmed in an exchange filing on Thursday that HDB Financial has filed its Red Herring Prospectus (RHP) with the Registrar of Companies. The IPO window will remain open until June 27, while anchor investors are scheduled to place their bids on June 24. The announcement has not only lifted HDFC Bank stock but is also shaping up as a critical development influencing near-term stock market strategy, with traders eyeing potential upside on the back of strong institutional demand.

HDB Financial Services IPO

The IPO price band for HDB Financial Services (HDBFS) is fixed at ₹700 to ₹740 per equity share (face value ₹10 each).

Investors must bid for a minimum of 20 equity shares, and in multiples of 20 thereafter.

IPO Dates:

Opens: Wednesday, June 25, 2025

Closes: Friday, June 27, 2025

Anchor Investor Bidding: Tuesday, June 24, 2025

Offer Structure for HDBF IPO:

Fresh Issue: Up to ₹2,500 crore

Offer for Sale (OFS): Up to ₹10,000 crore by HDFC Bank

HDFC Bank’s Board has approved the transfer of equity shares it holds in HDBFS for the OFS portion of the IPO.

HDFC Bank Upcoming Dividend

The Board of Directors recommended a dividend of ₹22.00 per equity share of the Bank of face value of ₹1/- each, for FY 2025, subject to shareholder approval.

Buy Rating for SBI from Jefferies

Alongside HDFC Surge Global brokerage firm Jefferies issued a “buy” recommendation on State Bank of India (SBI), assigning a target price of Rs 960 per share, implying a potential upside of 22 percent.

Jefferies projects a credit growth of 12 percent and deposit growth of 10 percent for the public sector lender, supported by adequate liquidity buffers. The bank is also expected to maintain a return on assets (RoA) of 1 percent despite facing near-term pressure on net interest margins (NIM) due to anticipated rate cuts.

In FY2025, SBI reported a decline in net profit, although net interest income (NII) registered a modest increase. Specifically, net profit dropped 10 percent compared to the same period last year, while NII rose by 2.7 percent to Rs 42,775 crore.

On the positive side, SBI’s asset quality showed sequential improvement. The gross non-performing assets (GNPA) ratio declined to 1.82 percent in the January–March quarter from 2.07 percent in the preceding quarter. The net NPA ratio also improved to 0.47 percent from 0.53 percent.

Geojit Financial Services also Upgrading SBI to a “buy” from “hold” with a revised target price of Rs 888 per share.

Among the 42 brokerages tracking SBI, 34 maintain a “buy” rating, 7 suggest “hold,” and only 1 recommends “sell.”

Stock Market Strategy - HDFC Bank

Intraday Trading Strategy

Range Monitoring: Trade within the current sideways range of ₹1,900–₹1,975.

Breakout Entry: Buy above ₹1,950 for potential upside targets of ₹2,025 and ₹2,050; sell below ₹1,900 for downside targets of ₹1,880 and ₹1,850.

Stop-Loss: Set a strict stop-loss at ₹1,900 for long positions to manage risk.

Momentum Indicators: Watch RSI (neutral at 51.27) and Stochastic RSI for negative crossover signals indicating short-term weakness.

Long-Term Investing Strategy

Invest before the record date (June 27, 2025) to secure the ₹22.00 per share dividend.

Support Level: Accumulate around ₹1,900, a key support level, for better entry points.

Breakout Target: Hold for a potential breakout above ₹1,975, targeting ₹2,025–₹2,050 in the medium term.

IPO Impact: Leverages positive sentiment from HDB Financial Services’ ₹12,500-crore IPO to boost HDFC Bank’s valuation.

Maintain a stop-loss at ₹1,880 to protect against unexpected corrections.

Focus on HDFC Bank’s strong fundamentals and institutional demand as a stable long-term investment.

Stock Market Strategy - SBI

Intraday Trading Strategy

Current Price Action: Trade around the current price of ₹796, up 1.59%, with focus on intraday momentum.

Resistance Levels: Target ₹810 and ₹825 on sustained buying; book profits if resistance is encountered.

Support Levels: Watch ₹785 as immediate support; a break below could lead to ₹775 or ₹760.

Stop-Loss: Set a stop-loss at ₹785 for long positions to limit downside risk.

Long-Term Investing Strategy

Buy Recommendation: Accumulate at current levels (₹796) or on dips near ₹775, aligning with Jefferies’ ₹960 and Geojit’s ₹888 target prices (22% and 11.5% upside, respectively).

Growth Drivers: Hold for projected 12% credit growth and 10?posit growth, supported by RBI’s monetary policies and tax cuts.

Asset Quality: Benefit from improving GNPA (1.82%) and net NPA (0.47%) ratios, indicating stronger fundamentals.

Set a stop-loss at ₹760 to protect against market corrections.

Leverage strong “buy” consensus (34/42 brokerages) for confidence in long-term upside.

Level up your investing game. Get an advanced Stock Market Strategy. Register now - www.intensifyresearch.com or call -9111777433

Investment in the securities market is subject to market risks.

#accurate stock tips#best bank nifty tips provider#best bank nifty option tips#stock cash market tips#share market advisory#ideal strategies#stock tips advisor#trading tips#ipo news#ipo alert

1 note

·

View note

Text

LIC soars 7.4% high on the back of 38% jump in net profit (Q4 results)

- Motilal Oswal sets a Target Price of ₹1050

- Macquarie sets TP of ₹1215

- Goldman Sachs ₹880 target

Get

- Services based on Investment Goals

- Timely Buy-Sell-Hold Insights

- Personalized Support from Our Experts

- Cutting-Edge Tracking & Comprehensive Reports

Register now - www.intensifyresearch.com or call 9111777433

#stock market#finance#share market#investing#banknifty#sensex#nifty prediction#nifty50#nse#economy#tradingopportunities#option trading#trading tips#bse sensex#bse

1 note

·

View note

Text

#stock broker#best stock broker in India#online stock broker#top 10 stock brokers India#Zerodha#Upstox#Groww#ICICI Direct#Angel One#HDFC Securities#5Paisa#Sharekhan#Motilal Oswal#Kotak Securities#stock trading India#stock trading app#Demat account#SEBI registered broker#discount broker#full service broker#online trading#share market India#investing in India#Indian stock market#Nifty 50#Sensex#financial planning#stock market beginners#stock market tips#investment platform India

0 notes

Text

28-JUNE-2024 BANKNIFTY 53300 CE S/L HIT. 52500 PE TGT1 HIT CE LOSS Rs. 5,226 PE TGT1 PROFIT Rs. 4,986

www.goldenoptions.in https://wa.me/6379365521

#banknifty#nifty#investing#option trading#nseindia#stock market#trading tips#share market#trade#youtube

0 notes

Text

7 Strategies for Successful Options Trading

Trading options within a single day or short-term has become a popular choice among traders looking to capitalize on price movements. But it takes talent, self-control, and practical tactics to master. TechnoFunda offers expert options trading tips and research.

7 Options Trading Strategies:

Strategy 1: Mastering Risk Management

Effective risk management is essential for options trading success. Always set a stop-loss to limit losses and define target prices to secure profits.

Strategy 2: Analyzing Market Trends

Being aware of market trends enables you to make wise choices. Study charts and patterns to identify potential opportunities.

Strategy 3: Choosing Liquid Options

Trading liquid options ensures quick execution and low slippage.

Strategy 4: Keeping Emotions in Check

Trading emotionally often leads to poor decisions. Stick to your trading plan and avoid reacting to every market move.

Strategy 5: Timing the Market

Timing is everything in options trading. The first and last hours of market sessions often have the highest volatility.

Strategy 6: Staying Updated with News

News directly impacts options prices. Track key events like policy announcements and earnings reports.

Strategy 7: Learning and Evolving

Continuous improvement is vital for long-term success. Analyze past trades to identify what worked and what didn’t.

Conclusion

Options trading offers immense potential but demands strategy, discipline, and continuous learning. TechnoFunda offers expert options trading tips and research.Visit TechnoFunda Wealth to get started today!

0 notes

Text

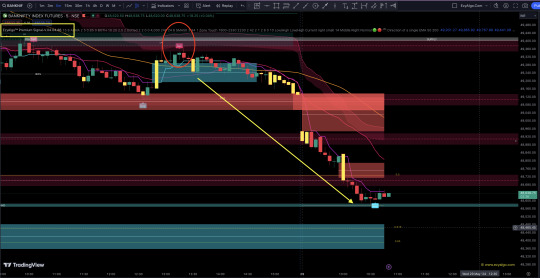

NIFTYBANK.NSE (BankNifty) Chart Update- Our Prediction On 27 May 2024 by the (EzyAlgo) Premium Signal Indicator

NIFTYBANK.NSE (BankNifty) Chart Update- Our Prediction On 27 May 2024, a notable spinning top candle indicated market indecision within a 400-500 point range. However, on 29 May 2024, the market opened below this range and moved decisively, achieving a target of approximately 500-600 points. This movement was confirmed by the (EzyAlgo) Premium Signal Indicator.

Updated Analysis:

Spinning Top Candle (27 May 2024): Initially indicated indecision within a 400-500 point range.

Breakout (29 May 2024): Market opened below the range and moved decisively.

Target Achieved: Approximately 500-600 points movement.

Indicator Confirmation: EzyAlgo Premium Signal Indicator confirmed the move.

Trading Implications:

Breakout Strategy: The decisive move below the range provided a clear breakout signal, leading to a significant price movement.

Indicator Use: Utilizing tools like the EzyAlgo Premium Signal Indicator can help confirm trading signals and improve decision-making.

By staying alert to breakout signals and leveraging reliable indicators, traders can capitalize on significant market moves effectively.

This strategy aims to provide a robust framework for identifying trading opportunities and optimizing trades

Get Access to EzyAlgo indicators: https://ezyalgo.com/Join our Free Telegram Channel: https://t.me/EzyAlgoSolutions

#stock market#nifty50#option trading#nifty option tips#niftytrading#technical analysis#economy#finance#forex trading#forexsignals#banknifty#bank nifty

0 notes